Hikvision Software Solutions and Large-Scale AI Models: The Future of VMS

In the evolving security technology landscape, the demand for integrated, intelligent video solutions in advanced video management software (VMS) is driving change. For security professionals, especially integrators and installers, staying ahead means delivering systems that are not just functional, but forward-thinking and scalable. Hikvision, the global leader in video surveillance technology, offers two robust platforms to meet a range of project requirements: HikCentral Professional and HikCentral Lite. Each is built to support streamlined deployment, flexible integration and advanced functionality — empowering professionals to offer more value to clients across industries.

HikCentral Professional: A modular platform built for scale

For large-scale and multi-site projects, HikCentral Professional provides a powerful foundation. This unified VMS platform brings together video surveillance, access control, visitor management, alarm systems and more — all through a flexible, modular architecture that supports over 100,000 channels in RSM mode.

Its plug-in structure is particularly valuable for integrators looking to customize deployments for verticals such as retail, education, manufacturing and critical infrastructure. Whether you’re building out a full-scale solution or phasing upgrades over time, the system’s architecture allows for precise tailoring without re-engineering.

HikCentral Lite is designed with simplicity and scalability at its core and supports AI-powered intelligent search functions for robust capabilities without the complexity. The system supports Windows, Android and iOS, making it adaptable across devices, and comes with:

16 free video channels and 2 free doors, with easy license upgrades (e.g., HX-LVSS1C for video, HX-LACS1DI for access)

AI-powered video content analysis (VCA) tools for rapid object and event search

Simple migration paths from legacy software like iVMS-4200

Lifetime software updates at no additional cost—helping integrators maintain system value over time.

A Comprehensive Guide to Safety Detectors

Safety detectors are an essential part of any home or business safety plan. They can detect a variety of hazards, including smoke, carbon monoxide, gas leaks, water leaks and intruders. By alerting people to danger early on, safety detectors can help prevent injuries, deaths and property damage.

Smoke detectors

Smoke detectors are the most common type of safety detector. They can detect smoke from a variety of sources, including fires, cooking and smoking. Smoke detectors come in two main types: ionization and photoelectric. Ionization smoke detectors are more responsive to fast-moving, flaming fires. Photoelectric smoke detectors are more responsive to slow-burning, smoldering fires. For the best protection, it is recommended to install both ionization and photoelectric smoke detectors in a home or business.

Uses and applications: Residential and commercial | Homes | Businesses | Warehouses | Any environment where fire is a safety or property damage concern

Heat detectors

Responding to changes in temperature, heat detectors are versatile tools. They find applications in environments where smoke detection might lead to false alarms, such as kitchens. These detectors are available in several temperature types. There are two detection types: fixed temperature and rate-of rise. Fixed temperature detectors activate when the heat reaches the preset range of the detector. The most common temperature types are 135°F (used for garages or dusty, dirty environments) and 194°F (attics or other high heat areas). Rate-of-rise detectors activate when the temperature in the room increases rapidly within a short period — typically, a 15-degree change in under a minute.

Uses and applications: Industrial and commercial | Garages | Kitchens | Areas with high humidity

Carbon monoxide detectors

Carbon monoxide (CO) is a colorless, odorless gas that can be deadly. Carbon monoxide detectors can detect CO leaks from appliances, such as furnaces, water heaters and stoves. They are indispensable in homes and businesses where any gas-powered device poses a potential risk. CO detectors come in two main types: electrochemical and semiconductor. Electrochemical CO detectors are more accurate and reliable than semiconductor CO detectors. Semiconductor CO detectors are less expensive than electrochemical CO detectors, but they are more prone to false alarms.

Uses and applications: Residential and commercial | Homes | Businesses | Restaurants | Warehouses | Any environment where gas-powered devices pose a potential risk

Combination smoke/carbon monoxide detectors

Combination detectors provide a dual function by integrating smoke and carbon monoxide detection capabilities. This not only streamlines safety measures but also reduces the number of devices required, making them a practical choice for comprehensive safety solutions. These types of detectors are a good option to provide a holistic approach to protection, especially in environments with multifaceted risks.

Uses and applications: Residential and commercial | Any environment or situation where streamlining the number of smoke and CO detection devices is preferred

Gas detectors

Gas detectors can detect a variety of gases, including propane and natural gas. They are often used in industrial and commercial settings to protect against gas leaks, but they can also be used in residential settings to protect against gas leaks from appliances and heaters. From residential kitchens to industrial facilities, these detectors ensure swift responses to gas leaks, helping to prevent catastrophic events.

Uses and applications: Primarily commercial | Restaurants | Hotels | Factories | Laboratories

Call us for all your Safety Detectors needs..

Ready to plan your next getaway to Yacht Haven Park & Marina?

Don’t miss this exclusive offer: enjoy 30% off summer stays when you book by January 31, 2025.Imagine vibrant sunsets, tranquil waterfront views, and endless adventures at our upscale RV resort and marina in sunny Fort Lauderdale. Secure your spot now for a winter getaway or plan ahead for summer fun!

Homeowner’s Guide to the Federal Tax Credit for Solar Photovoltaics

Disclaimer: This guide provides an overview of the federal investment tax credit for residential solar photovoltaics (PV). (See the Federal Solar Tax Credits for Businesses for information for businesses). It does not constitute professional tax advice or other professional financial guidance and may change based on additional guidance from the Treasury Department. Please see their published Fact Sheet for additional information. The below guide should not be used as the only source of information when making purchasing decisions, investment decisions, tax decisions, or when executing other binding agreements.

Residential Rooftop Solar Installation

State tax credits for installing solar PV generally do not reduce federal tax credits—and vice versa. However, when you receive a state tax credit, the taxable income you report on your federal taxes may be higher than it otherwise would have been because you now have less state income tax to deduct. (The Tax Cuts and Jobs Act of 2017 placed a $10,000 limit on state and local tax (SALT) deduction through 2025. Therefore, if a homeowner is still paying more than $10,000 in SALT after claiming a state tax credit, the state tax credit benefit would not effectively be reduced by the federal tax rate, as it would not impact federal taxes (due to the SALT limit).) The end result of claiming a state tax credit is that the amount of the state tax credit is effectively taxed at the federal tax level.

What is a tax credit?

A tax credit is a dollar-for-dollar reduction in the amount of income tax you would otherwise owe. For example, claiming a $1,000 federal tax credit reduces your federal income taxes due by $1,000. The federal tax credit is sometimes referred to as an Investment Tax Credit, or ITC, though is different from the ITC offered to businesses that own solar systems.

What is the federal solar tax credit?

The federal residential solar energy credit is a tax credit

that can be claimed on federal income taxes for a percentage of the cost of a solar PV system paid for by the taxpayer. (Other types of renewable energy are also eligible for similar credits but are beyond the scope of this guidance.)

The installation of the system must be complete during the tax year.

Solar PV systems installed in 2020 and 2021 are eligible for a 26% tax credit. In August 2022, Congress passed an extension of the ITC, raising it to 30% for the installation of which was between 2022-2032. (Systems installed on or before December 31, 2019 were also eligible for a 30% tax credit.) It will decrease to 26% for systems installed in 2033 and to 22% for systems installed in 2034. The tax credit expires starting in 2035 unless Congress renews it.

There is no maximum amount that can be claimed.

Am I eligible to claim the federal solar tax credit?

You might be eligible for this tax credit if you meet the following criteria:

Your solar PV system was installed between January 1, 2017, and December 31, 2034.

The solar PV system is located at a residence of yours in the United States.

Either: You own the solar PV system (i.e., you purchased it with cash or through financing but you are neither leasing the system nor nor paying a solar company to purchase the electricity generated by the system).

Or, you purchased an interest in an off-site community solar project, if the electricity generated is credited against, and does not exceed, your home’s electricity consumption. Notes: the IRS issued a statement (see link above) allowing a particular taxpayer to claim a tax credit for purchasing an interest in an off-site community solar project. However, this document, known as a private letter ruling or PLR, may not be relied on as precedent by other taxpayers. Also, you would not qualify if you only purchase the electricity from a community solar project.

The solar PV system is new or being used for the first time. The credit can only be claimed on the “original installation” of the solar equipment.

What expenses are included?

The following expenses are included:

Solar PV panels or PV cells (including those used to power an attic fan, but not the fan itself)

Contractor labor costs for onsite preparation, assembly, or original installation, including permitting fees, inspection costs, and developer fees

Balance-of-system equipment, including wiring, inverters, and mounting equipment

Energy storage devices

that have a capacity rating of 3 kilowatt-hours (kWh) or greater (for systems installed after December 31, 2022). If the storage is installed in a subsequent tax year to when the solar energy system is installed it is still eligible, however, the energy storage devices are still subject to the installation date requirements). Note: A private letter ruling may not be relied on as precedent by other taxpayers.

Sales taxes on eligible expenses

How do other incentives I receive affect the federal tax credit?

For current information on incentives, including incentive-specific contact information, visit the Database of State Incentives for Renewables and Efficiency website.

Rebate from My Electric Utility to Install Solar

Under most circumstances, subsidies provided by your utility to you to install a solar PV system are excluded from income taxes through an exemption in federal law

. When this is the case, the utility rebate for installing solar is subtracted from your system costs before you calculate your tax credit. For example, if your solar PV system installed in 2022 cost $18,000, and your utility gave you a one-time rebate of $1,000 for installing the system, your tax credit would be calculated as follows: ($18,000 - $1,000) * 0.30 = $5,100

However, payments from a public utility to compensate for excess generated electricity not consumed by the taxpayer but delivered to the utility’s electrical grid (for example, net metering credits) are not subsidies for installing qualifying property and do not affect the taxpayer’s credit qualification or amounts.

Payment for Renewable Energy Certificates

When your utility, or other buyer, gives you cash or an incentive in exchange for renewable energy certificates or other environmental attributes of the electricity generated (either upfront or over time), the payment likely will be considered taxable income

. If that is the case, the payment will increase your gross income, but it will not reduce the federal solar tax credit. Note: A private letter ruling may not be relied on as precedent by other taxpayers.

Rebate from My State Government

Unlike utility rebates, rebates from state governments generally do not reduce your federal tax credit. For example, if your solar PV system was installed in 2022, installation costs totaled $18,000, and your state government gave you a one-time rebate of $1,000 for installing the system, your federal tax credit would be calculated as follows:$18,000 * 0.30 = $5,400 State Tax Credit

State tax credits for installing solar PV generally do not reduce federal tax credits—and vice versa. However, when you receive a state tax credit, the taxable income you report on your federal taxes may be higher than it otherwise would have been because you now have less state income tax to deduct. (The Tax Cuts and Jobs Act of 2017 placed a $10,000 limit on state and local tax (SALT) deduction through 2025. Therefore, if a homeowner is still paying more than $10,000 in SALT after claiming a state tax credit, the state tax credit benefit would not effectively be reduced by the federal tax rate, as it would not impact federal taxes (due to the SALT limit).) The end result of claiming a state tax credit is that the amount of the state tax credit is effectively taxed at the federal tax level.

Read More About How to Go Solar

Experiance Unmatched Internet with Nomad Air

Enjoy the easiest and quickest internet setup with our top-rated modem, free for new customers. Get online effortlessly and stay connected.

Join America's Largest Wireless Internet Provider Featuring

-

Pricing

Experience lightning-fast Internet speeds and Advanced WiFi featuring state-of-the-art security.

What plan is good for me? MOST POPULAR100Mbps Unlimited Internet

$99 .95/mo

$119.95/mo After 1mo. -

High-Speed Download up to 100Mbps

- 1080p HD video streaming

- Good gaming latency

- No Contract, No Credit Check

- Unlimited & Unthrottled

-

High-speed download up to 200Mbps

- Ultra HD 4K video streaming

- Excellent gaming latency

- No Contract, No Credit Check Unlimited & Unthrottled

200Mbps Unlimited Internet

$149 .95/mo

$169.95/mo After 1mo.What You Need to Know About Wi-Fi 7

What You Need to Know About Wi-Fi 7

"While Wi-Fi 7 will offer higher speeds between wireless devices, increased efficiency and capacity and improved interference management, very few wireless devices today support Wi-Fi 7. The Internet connection also has to support those speeds to take advantage of them,” explains Lewis Donzis, CEO of PerfTech, which is the creator of the commercial-grade Island Router.

“However, Wi-Fi 7 is geared to make those enhancements available in the future both from a device perspective and a provider perspective

The world of Wi-Fi continues to push forward at a rapid pace. A few years ago, wireless networking technology went from Wi-Fi 5 to Wi-Fi 6 and now we're quickly transitioning to Wi-Fi 7. The change from Wi-Fi 5 to Wi-Fi 6 brought several improvements, and now custom integrators and their homeowner clients will be able to experience numerous more enhancements. Some chief benefits of Wi-Fi 7 (802.11be) include even faster speeds, interference-free throughput to ensure those speeds are achieved, the ability to transmit more packets of data and capabilities to connect more devices and users. For now, we are only on the cusp of what is possible with Wi-Fi 7 as more product offerings catch up with the technology. Early adopters who are willing to spend more to upgrade their wireless networks will gain the initial experiences.

Wi-Fi 7 features and benefits

While Wi-Fi 7 will offer higher speeds between wireless devices, increased efficiency and capacity and improved interference management, very few wireless devices today support Wi-Fi 7, especially IoT devices. The Internet connection also has to support those speeds to take advantage of them,” explains Lewis Donzis, CEO of PerfTech, which is the creator of the commercial-grade Island Router.

“However, Wi-Fi 7 is geared to make those enhancements available in the future both from a device perspective and a provider perspective.

Most of today's home routers, even those that are wired, are not prepared for the extremely intensive applications expected to come down the road,” he says. Wi-Fi 7 is setting the foundation for the necessary bandwidth and throughput.

“While today's Wi-Fi routers in the home AV arena are making improvements in their wireless capabilities, few, if any, have a router function that can handle the speed and capacity requirements of a now more heavily loaded wireless component on the network,” he says.

“It will land on the integrator to find and install a router whose hardware and software can accommodate Wi-Fi 7 and have been designed for this scenario.

Most of today's home routers, even those that are wired, are not prepared for the extremely intensive applications expected to come down the road,” he says. Wi-Fi 7 is setting the foundation for the necessary bandwidth and throughput.

“While today's Wi-Fi routers in the home AV arena are making improvements in their wireless capabilities, few, if any, have a router function that can handle the speed and capacity requirements of a now more heavily loaded wireless component on the network,” he says.

“It will land on the integrator to find and install a router whose hardware and software can accommodate Wi-Fi 7 and have been designed for this scenario.

Comparing Wi-Fi 5, Wi-Fi 6 and Wi-Fi 7

“The main difference between Wi-Fi 6 and Wi-Fi 7 is higher speed and use of a wide open 6GHz channel,” notes Andrew Ward, business development manager for enterprise-level provider Access Networks.

“Each iteration of Wi-Fi is meant to solve a problem facing connectivity at the time and improve on the previous certification,” he comments.

“Wi-Fi 5 gave us faster transmission and a dedicated backhaul 5GHz band, resulting in better throughput. Wi-Fi 6 focused on connectivity, spectral efficiency, security and improved battery life, resulting in greater Wi-Fi stability and higher capacity.”

In accordance with the Wi-Fi Alliance, Wi-Fi 7 certified products must deliver the following characteristics, Ward details:

- 320MHz channel width in the 6GHz band, double that of Wi-Fi 6

- Multilink Operation (MLO) allowing aggregate connection between spectra

- 4K Quadrature Amplitude Modulation (QAM), which has 20% higher transmission rates than 1024 QAM in Wi-Fi 6

- 'Puncturing,' which allows use of most of a channel, even with interference

Bjørn Jensen, founder and CEO of network and cybersecurity specialist WhyReboot, elaborates on why “This is a huge upgrade compared to anything that has come out previously for multiple reasons.”

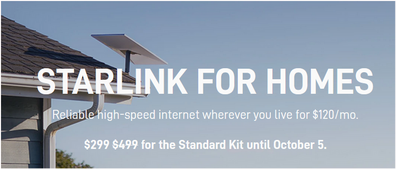

STARLINK FOR HOMES

STREAM MOVIES, MAKE VIDEO CALLS, GAME & MORE...

Reliable high-speed internet wherever you live for $120/mo.

HIGH-SPEED INTERNET NO MATTER HOW REMOTE

Engage in activities that have historically not been possible with satellite internet. Made possible via the world’s largest constellation of highly advanced satellites operating in a low orbit around the Earth.

DESIGNED FOR SELF-INSTALL

Set up Starlink with just two steps. Instructions work in either order:

1 PLUG IT IN

2 POINT AT SKY

Starlink requires an unobstructed view of the sky. Download the Starlink app to determine your best install location.

Unlimited data,

No Contracts

All Starlink subscription plans include unlimited high-speed data on land with no long-term contracts or commitments.